Vermont Property Tax Due Dates . important information about vt property taxes; Tax payment due dates for 2022/2023 tax year are: burlington residents whom declare their burlington home as their primary residence are eligible for the homestead tax. when are property tax bills mailed and when are they due? The property tax bills are mailed once a year in august. file these vermont tax forms every year to qualify for the lower, residential tax rate and a property tax adjustment, if eligible. Contact your town to find out the tax. Learn how to file and pay property transfer tax, read. Here is what you need to know. Individual and property owner due dates. tax bills are generally mailed to property owners 30 days prior to the property tax due date.

from www.formsbank.com

Individual and property owner due dates. Contact your town to find out the tax. The property tax bills are mailed once a year in august. Learn how to file and pay property transfer tax, read. file these vermont tax forms every year to qualify for the lower, residential tax rate and a property tax adjustment, if eligible. tax bills are generally mailed to property owners 30 days prior to the property tax due date. important information about vt property taxes; Tax payment due dates for 2022/2023 tax year are: when are property tax bills mailed and when are they due? Here is what you need to know.

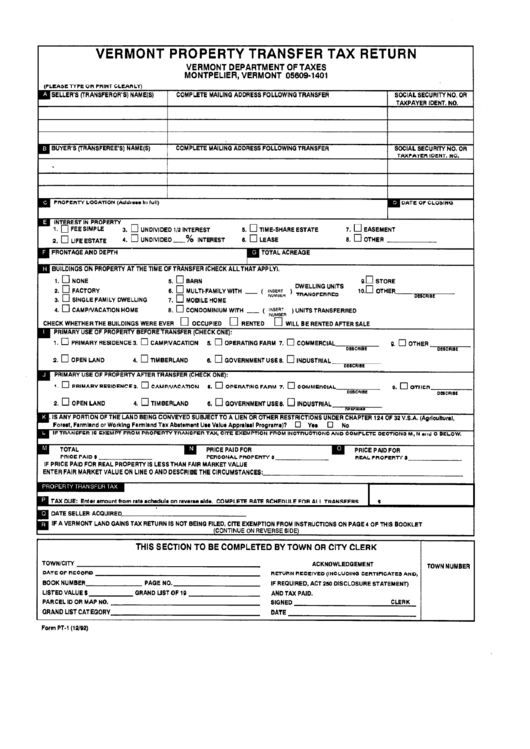

Form Pt1 Vermont Property Transfer Tax Return Department Of Taxes

Vermont Property Tax Due Dates when are property tax bills mailed and when are they due? when are property tax bills mailed and when are they due? Tax payment due dates for 2022/2023 tax year are: burlington residents whom declare their burlington home as their primary residence are eligible for the homestead tax. tax bills are generally mailed to property owners 30 days prior to the property tax due date. important information about vt property taxes; Contact your town to find out the tax. Individual and property owner due dates. Here is what you need to know. file these vermont tax forms every year to qualify for the lower, residential tax rate and a property tax adjustment, if eligible. Learn how to file and pay property transfer tax, read. The property tax bills are mailed once a year in august.

From poweshiekcounty.org

March Property Taxes are due by March 31, 2023 Poweshiek County, Iowa Vermont Property Tax Due Dates tax bills are generally mailed to property owners 30 days prior to the property tax due date. Individual and property owner due dates. file these vermont tax forms every year to qualify for the lower, residential tax rate and a property tax adjustment, if eligible. burlington residents whom declare their burlington home as their primary residence are. Vermont Property Tax Due Dates.

From www.formsbank.com

Fillable Form Pt172 Property Transfer Tax Return Vermont printable Vermont Property Tax Due Dates The property tax bills are mailed once a year in august. Learn how to file and pay property transfer tax, read. when are property tax bills mailed and when are they due? important information about vt property taxes; burlington residents whom declare their burlington home as their primary residence are eligible for the homestead tax. Tax payment. Vermont Property Tax Due Dates.

From digital.vpr.net

A New Idea For Paying For Education Vermont Public Radio Vermont Property Tax Due Dates tax bills are generally mailed to property owners 30 days prior to the property tax due date. important information about vt property taxes; burlington residents whom declare their burlington home as their primary residence are eligible for the homestead tax. file these vermont tax forms every year to qualify for the lower, residential tax rate and. Vermont Property Tax Due Dates.

From fawntuesday.pages.dev

Corporate Tax Due Dates 2024 Jaime Annabal Vermont Property Tax Due Dates burlington residents whom declare their burlington home as their primary residence are eligible for the homestead tax. important information about vt property taxes; tax bills are generally mailed to property owners 30 days prior to the property tax due date. file these vermont tax forms every year to qualify for the lower, residential tax rate and. Vermont Property Tax Due Dates.

From www.cavendishvt.com

VT Property Tax Credit Information — Town of Cavendish, Vermont Vermont Property Tax Due Dates file these vermont tax forms every year to qualify for the lower, residential tax rate and a property tax adjustment, if eligible. Here is what you need to know. when are property tax bills mailed and when are they due? burlington residents whom declare their burlington home as their primary residence are eligible for the homestead tax.. Vermont Property Tax Due Dates.

From www.cbsnews.com

First installment of Cook County property taxes due April CBS Chicago Vermont Property Tax Due Dates file these vermont tax forms every year to qualify for the lower, residential tax rate and a property tax adjustment, if eligible. The property tax bills are mailed once a year in august. important information about vt property taxes; Individual and property owner due dates. burlington residents whom declare their burlington home as their primary residence are. Vermont Property Tax Due Dates.

From www.pinterest.com

Chart 4 Vermont Local Tax Burden by County FY 2015.JPG Vermont Vermont Property Tax Due Dates burlington residents whom declare their burlington home as their primary residence are eligible for the homestead tax. Here is what you need to know. Contact your town to find out the tax. Tax payment due dates for 2022/2023 tax year are: file these vermont tax forms every year to qualify for the lower, residential tax rate and a. Vermont Property Tax Due Dates.

From www.dochub.com

Vermont property tax return Fill out & sign online DocHub Vermont Property Tax Due Dates important information about vt property taxes; file these vermont tax forms every year to qualify for the lower, residential tax rate and a property tax adjustment, if eligible. burlington residents whom declare their burlington home as their primary residence are eligible for the homestead tax. Learn how to file and pay property transfer tax, read. when. Vermont Property Tax Due Dates.

From georgecfaganxo.blob.core.windows.net

Property Tax Due Dates By State at Jane Bowlin blog Vermont Property Tax Due Dates tax bills are generally mailed to property owners 30 days prior to the property tax due date. burlington residents whom declare their burlington home as their primary residence are eligible for the homestead tax. The property tax bills are mailed once a year in august. Tax payment due dates for 2022/2023 tax year are: when are property. Vermont Property Tax Due Dates.

From www.propertyrebate.net

Vt Property Tax Rebate Calculator Vermont Property Tax Due Dates Learn how to file and pay property transfer tax, read. The property tax bills are mailed once a year in august. tax bills are generally mailed to property owners 30 days prior to the property tax due date. important information about vt property taxes; file these vermont tax forms every year to qualify for the lower, residential. Vermont Property Tax Due Dates.

From www.vermontbiz.com

Vermont relies on property and personal taxes Vermont Business Vermont Property Tax Due Dates tax bills are generally mailed to property owners 30 days prior to the property tax due date. Individual and property owner due dates. Here is what you need to know. file these vermont tax forms every year to qualify for the lower, residential tax rate and a property tax adjustment, if eligible. when are property tax bills. Vermont Property Tax Due Dates.

From www.signnow.com

Vt Homestead Property Tax Adjustment 20202024 Form Fill Out and Sign Vermont Property Tax Due Dates file these vermont tax forms every year to qualify for the lower, residential tax rate and a property tax adjustment, if eligible. Here is what you need to know. when are property tax bills mailed and when are they due? burlington residents whom declare their burlington home as their primary residence are eligible for the homestead tax.. Vermont Property Tax Due Dates.

From eydielucille.pages.dev

2024 Tax Deadlines List Usa Zaria Therine Vermont Property Tax Due Dates when are property tax bills mailed and when are they due? file these vermont tax forms every year to qualify for the lower, residential tax rate and a property tax adjustment, if eligible. The property tax bills are mailed once a year in august. Contact your town to find out the tax. Tax payment due dates for 2022/2023. Vermont Property Tax Due Dates.

From www.peetlaw.com

Property Tax Adjustments in Vermont Understanding Prebates and Eligibility Vermont Property Tax Due Dates Tax payment due dates for 2022/2023 tax year are: Learn how to file and pay property transfer tax, read. The property tax bills are mailed once a year in august. burlington residents whom declare their burlington home as their primary residence are eligible for the homestead tax. Contact your town to find out the tax. important information about. Vermont Property Tax Due Dates.

From editable-form.com

Manage Documents Using Our Editable Form For Property Tax Credit Chart Form Vermont Property Tax Due Dates Individual and property owner due dates. Here is what you need to know. burlington residents whom declare their burlington home as their primary residence are eligible for the homestead tax. The property tax bills are mailed once a year in august. Tax payment due dates for 2022/2023 tax year are: Learn how to file and pay property transfer tax,. Vermont Property Tax Due Dates.

From www.formsbank.com

Form Hs122w Vermont Homestead Declaration And/or Property Tax Vermont Property Tax Due Dates important information about vt property taxes; tax bills are generally mailed to property owners 30 days prior to the property tax due date. burlington residents whom declare their burlington home as their primary residence are eligible for the homestead tax. Individual and property owner due dates. The property tax bills are mailed once a year in august.. Vermont Property Tax Due Dates.

From tax.vermont.gov

Understanding Your Property Tax Bill Department of Taxes Vermont Property Tax Due Dates tax bills are generally mailed to property owners 30 days prior to the property tax due date. file these vermont tax forms every year to qualify for the lower, residential tax rate and a property tax adjustment, if eligible. important information about vt property taxes; burlington residents whom declare their burlington home as their primary residence. Vermont Property Tax Due Dates.

From fawntuesday.pages.dev

Corporate Tax Due Dates 2024 Jaime Annabal Vermont Property Tax Due Dates Learn how to file and pay property transfer tax, read. important information about vt property taxes; when are property tax bills mailed and when are they due? Tax payment due dates for 2022/2023 tax year are: tax bills are generally mailed to property owners 30 days prior to the property tax due date. Contact your town to. Vermont Property Tax Due Dates.